What is SMEColony?

SMEColony app is an open platform developed by Affin Bank. SMEColony app is the first mobile application designed for SME (Small and Medium Enterprise) community development in Malaysia. It is a reference platform and one-stop resource to support your SME business. There is no requirement or subscription payment to be a member or user for this mobile app.

Why SMEColony?

Before knowing the feature of this mobile app, we can exactly see the accomplishment of SMEColony from the awards Affin Bank collected. For instance, the lastest award is from Digital CX Awards 2020, SMEColony gets the Best Digital Customer Experience in SME Banking awards. You should consider on an award-winning app which operated by the well-experienced company, Affin Bank. Nowadays in business, the demand of a mobile phone is more than a computer or laptop. Most of the business start doing tasks by using a mobile phone because it is easier to access. In addition, this mobile app is user-friendly. Therefore, the convenience will bring a huge improvement and raise up the effectiveness of your SME business.

Table of Content

1.0 SMEngage

2.0 Resources

3.0 Start-up Exclusives

4.0 Worcfoz

5.0 Financial Solutions

The Ways to Power Up Your Business:

SMEColony provides a complete solution for SMEs to improve their insight into the business, enhance the benefit of financial and expand their business networking. The solution will absolutely power up your business in an efficient way.

1.0 SMEngage

This solution will help you to improve your engagement in the SME business field very much. This mobile app provides 3 ways to help you engage in SME by using this SMEngage solution.

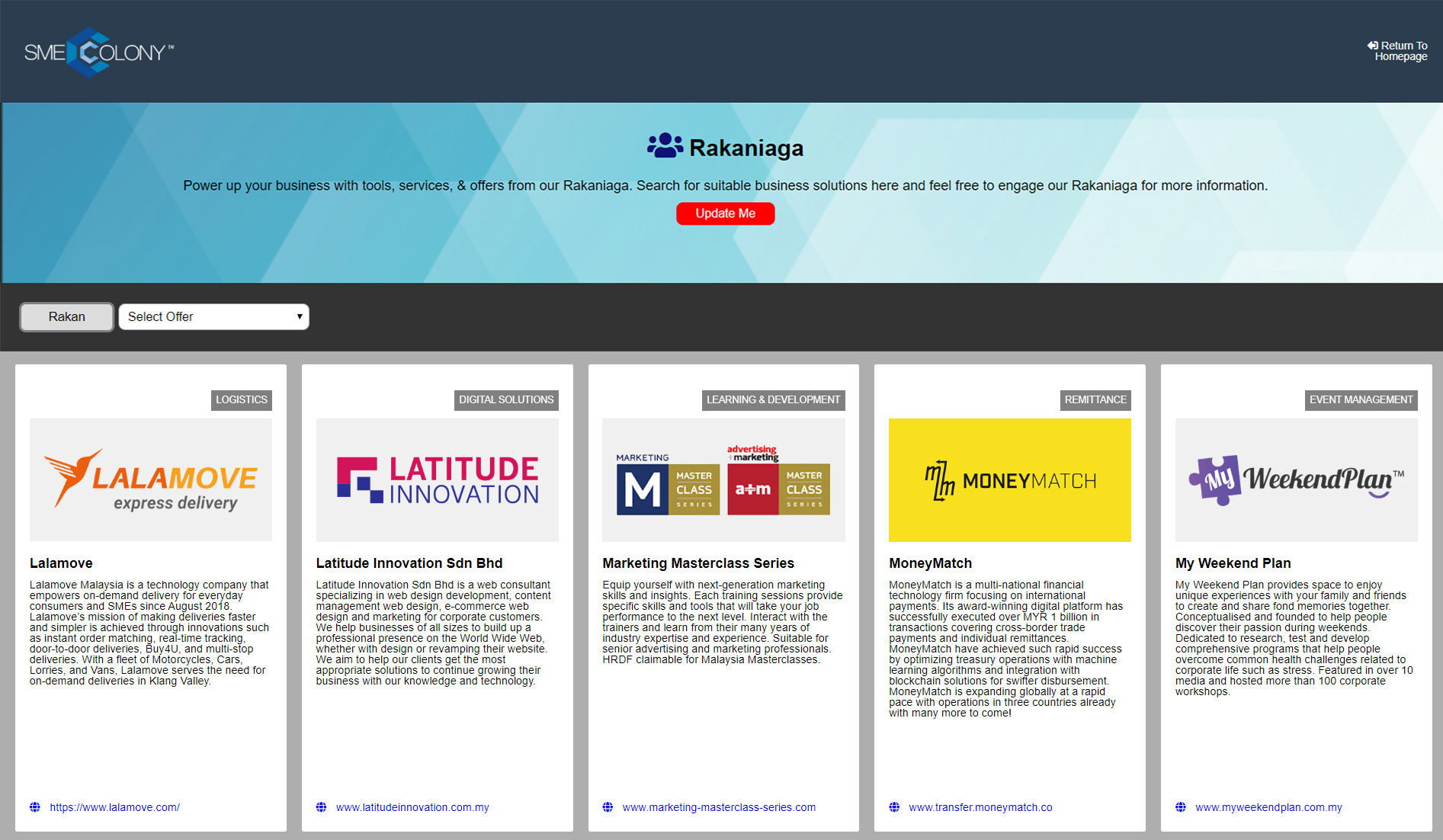

1.1 Rakaniaga

It is really proud to announce that Latitude Innovation Sdn Bhd is one of the Rakaniaga. Rakaniaga is the partnership of Affin Bank SMEColony. There are up to 45 partnerships for you to refer to. The app clearly lists out every partnership with the logo, field and description of the company. You can click the link provided to visit their website and know more about them. They are ready to provide several offers, services and tools to support your business.

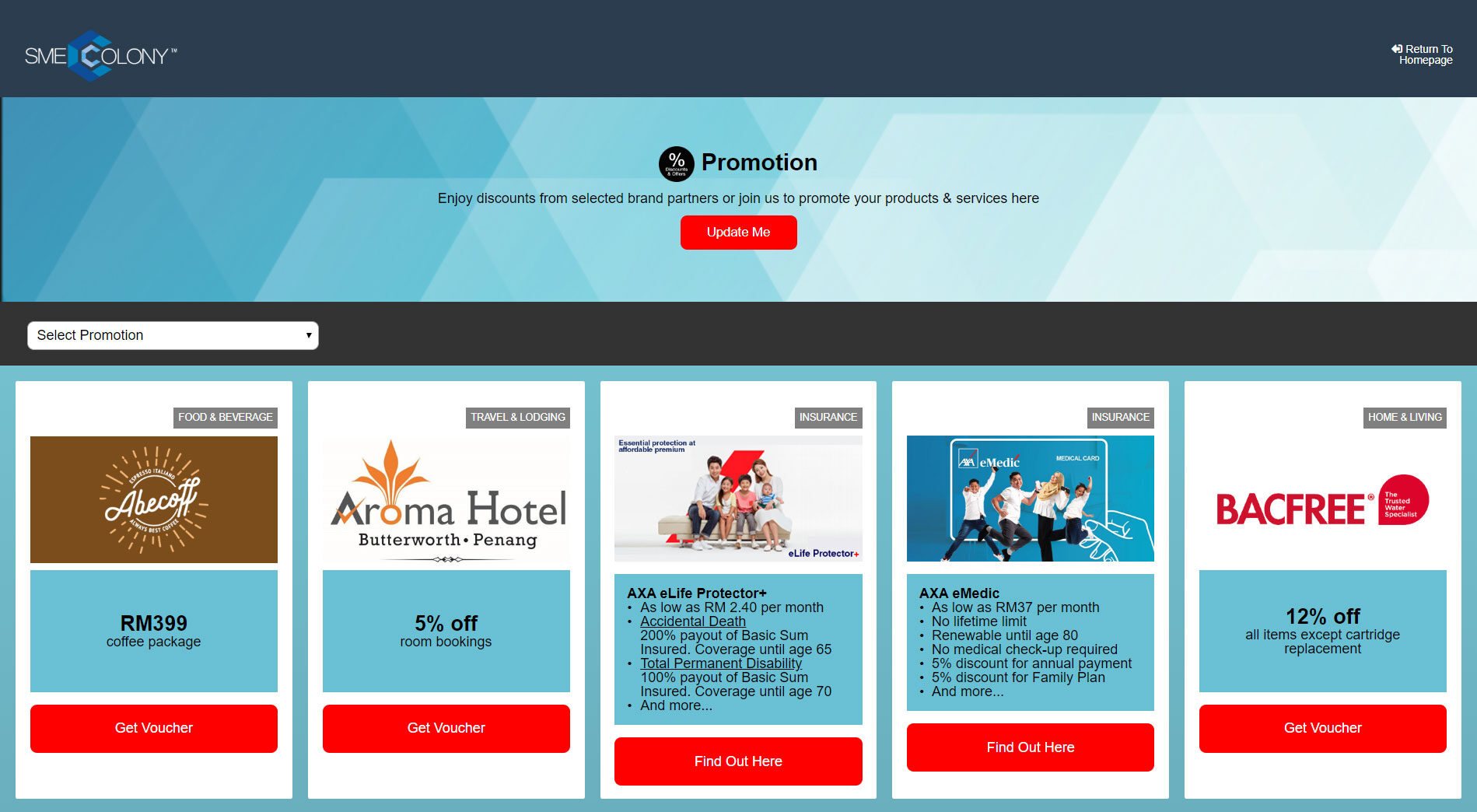

1.2 Promotion

Promotion is one of the ways most of the SMEs choose. SMEs promote their products and service on this mobile app with an exclusive discount. The discount is only valid for SMEColony users. It is easy to read on the category, name of the company and the detail of discount with the simple interface. You can choose either to promote your product or enjoy the discount here. For getting a discount, you can search for the promotion by selecting the category. You just need to click into the voucher to get the promo code and enjoy the discount easily.

1.3 SME Bizchat

For SME Bizchat, Affin Bank will organize an event for a speech by SME industry innovator. They will share and update the latest marketing information to you. Besides, you can enhance your business knowledge through the SME BizChat sharing sessions too. It is a good chance to interact with numerous SME employers from Malaysia. For sure, you will reduce spending time on research the information. After that, you will discover the actual ways to grow your business effectively. This mobile app will show you the date, location, name of the speaker, title and description clearly.

2.0 Resources

For managing SME business, we must have the latest news and information in this particular field. Hence, this mobile app will help you to get a deeper insight into business by providing you sufficient information. This mobile app provides 6 categories of resources for your references. The categories including “Reports & Articles“, “Government Agencies“, “Videos & Podcasts“, “Halal Businesses“, “Recognitions & Certifications” and “Our Rates“.

By reading “Reports & Articles”, you will get the information about SME weekly news, economic update, BizChat Collection and several articles. It brings you updated information about SMEs. Besides, you can join the events or programmes conducted by government agencies such as SMECorp Malaysia, SITEC and SIRIM. Furthermore, when you are tired of reading, you can watch the video from “Videos & Podcasts”.

Moreover, Malaysia being a Halal hub that produces numerous Halal products. It is great to have a Halal certified on your products or services. You may refer to the information on “Halal Businesses” for development. In addition, you can nominate your company to get the awards for business recognition. You can also try to get certification for your products or services. Lastly, Foreign Currencies, Base Rate (BR), Base Lending Rate (BLR) and Base Financing Rate (BFR) and Fixed Deposit / Term Deposit-i rates can be found at “Our Rates”. Therefore, you can know the latest rates around the world.

3.0 Start-up Exclusives

For SMEs, we know that it is not easy to start up a business successfully. It needs a lot of effort in researching, planning, managing and so on. Conversely, SMEColony provides Start-up Exclusive which can help and guide you to start up your business. You will shorten the time which spends on researching professional knowledge. The solutions are ready for you. In addition, to apply Start-up Exclusives, do pay attention to the eligibility requirements for every scheme provided.

3.1 Transactional

In Start-up Exclusives, this mobile app offers SMEssential solution. It provides transaction management for SMEs. Therefore, you will be able to control the cash flow of your business wisely. With this solution, you will get banking accounts which provided for SME business needs. They also provide a multi-tier interest or profit rate for your business. It is easier to manage the movement of money with a comprehensive solution. You may click the link above to refer to the information of SMEssential.

3.2 Financing

Secondly, there are 2 schemes for financing which are SMEmerge-i Start-Up Financing Scheme and SMEmerge Start-Up Financing Scheme. You need to choose a solution based on the type of your company. They will provide financial support to expand your business. It is easier for you to start up your finance and improves your business effectively.

3.3 Protection

Thirdly, SMEasy Protect is provided for the protection of your business. SMEasy Protect is a business risk protection plan which comes with 4 schemes options. You can choose the multiple schemes of RM15, RM45, RM99 or RM199 for the annual premium plan. It is coverage up to RM250,000 for the benefits in up to 9 types of unexpected situations and unforeseen events. For instance, accidental death coverage, emergency fund benefits, utility bill protection and numerous benefits. The most important eligibility is the person must be the business owner and company director. Therefore, you are able to manage your business risk by applying for the insurance or takaful which coverage with a reasonable price premium plan. After that, you are ready to face any trouble in your business every time.

3.4 Advisory & Support

After applying the solutions above, you may face more unpredictable challenges in your business start-up too. When you are poor-experienced in SME, you will need more professional knowledge for it. Here is a platform to provide you a consultation that will help you in solving your difficulties and more start-up business needs. SMEColony’s relationship managers and partners will help you with their professional advice and information.

There are 3 more ways to support the SME business start-up which is work on networking, resources and collaboration. Firstly, you can choose the SMEngage solution to expand your business networking. Secondly, the resources of SMEColony will definitely help you to get a better understanding of SME business and the start-up needs. Lastly, collaboration also an important element to start up your business. You can participate in the collaboration with SITEC, Mystartr and Rakaniaga of SMEColony. You may click the link to refer back the information of SMEngage, resources and Rakaniaga above.

4.0 Worcfoz

Worcfoz is a new scheme which associated with the retention and the involvement between employer and employee. For example, provide workplace rewards, insurance protection and human resource development for them. Worcfoz comes with 4 main strategies which are planning, protection, privilege and progress for the management of SME business. With this solution, the SME business will be able to build an effective and smart team to grow the business. It is an upcoming scheme, stay tuned for the practical tool for your business.

5.0 Financial Solutions

Finance is the backbone of every business organization. It is a significant part to ensure your business is running well. Hence, SMEColony provides financial solutions to improve the effectiveness and profitability of your SME business. There are 6 financial solutions are offered below.

5.1 Deposits

Instead of control the movement of money, the action of improving cash flow also an important part to do so. The reason is you can identify the performance of your business by the cash flow. The solution provides up to 11 types of deposit accounts for you to choose from. Besides that, I recommend SMEdge-i Current Account and SMEdge Current Account which are specially designed for SMEs. The same features of both accounts are Cheque Book Facility and Corporate Internet Banking. Furthermore, the difference between these 2 accounts is SMEdge-i Current Account provides a monthly statement. Conversely, SMEdge Current Account provides calculation of interest daily. The features are really suitable to enhance the flow of money in and out of the SME business. Moreover, you can also choose other types of deposit accounts based on the features and benefits.

5.2 Financing

After improving the cash flow, you will need to run a new project to raise business growth. For this, you will need financing support for the operation. There are up to 15 types of schemes but I only suggest choosing SMEmerge-i Start-Up Financing or SMEmerge Start-Up Financing. Both of them provide financing amounts which up to RM300,000 with the same operation period and same financing tenure period. Conversely, the difference is SMEmerge-i Start-Up Financing provides term financing facility but another provides term loan facility. Subsequently, take note of the eligibility of the scheme, choose the most suitable scheme for your business. Therefore, the operating funds will be provided before you start the new project.

5.3 Trade

The financial solution also provides a wide range of trade facilities for SMEs including import and export. There are more than 20 schemes for the facilities of import, export and bank guarantees. Bank Guarantee is very important. It is an irreversible promise issued by a bank. It works with the money to cover the loss of the applicants when they fail to perform their obligations under the agreement to the Beneficiary. Moreover, choose wisely based on the requirement stated and the benefit you want to bring it into the trading of your business.

5.4 Cash Management

With the Cash Management solution, a safe Corporate Internet Banking (CIB) services are provided. The features are account management, cheque management, payment services, bulk payment, enrichment services and high standard security. It is more convenient and secured to do the banking transaction with your business account. The efficiency of the operation will be increasing due to easiness and time-saving.

5.5 Bancatakaful & Bancassurance

After enhancing the performance of your business, you definitely need a business risk protection plan to prepare for an unexpected situation. There are several types of plans provided including Bancatakaful Family, Bancatakaful Commercial, Bancassurance Life and Bancassurance General. From those 10 plans, I suggest SMEasy Protect-i from Bancatakaful Commercial, SMEasy Protect and SMElixir Protect from Bancassurance General.

Although the name of SMEasy Protect-i and SMEasy Protect schemes looks similar, but the eligibility, features and benefits of them are slightly different. For example, SMEasy Protect-i is providing Financing Protector Benefits but SMEasy Protect is providing Loan Protector Benefits. Besides that, SMElixir Protect provides 3 premium plans with the prices of RM1000, RM2000 & RM5000. It aims to assist you for a quick restoration after any danger incident happens including fire, flood and others. Take note of choosing the scheme wisely based on your situation.

5.6 Other Services

For other services, they also provide Remittance, Islamic Investment Account Platform, Merchant Terminal Service, TaPay Biz App (Merchant App) and Affin Islamic Debit & Credit Card. Both of these are advanced services for SME businesses. If it is suitable for your business, you may apply for better financial management. SMEColony will keep providing support and help for your business.

5.7 SMEssential

In the Financial Solution, SMEColony offers a SMEssential solution for SMEs. In this solution, they provide Company Current Account, Fixed Deposit, SMEdge Current Account, Corporate Internet Banking (CIB), Merchant Terminal Service, Bank Guarantees and SMEasy protect. It is eligible for all types of businesses. Besides, it is also prepared for someone who has no idea to choose the financial solution one by one. This solution can provide comprehensive and basic SME business needs for SMEs. Hence, it is a good choice for you if you cant figure out other types of schemes in the financial solution.

Conclusion

In conclusion, SMEColony app is really an excellent practical tool to power up your business. You should get this awesome mobile app for your SME business too! In addition, it is proud to announce that Latitude Innovation Sdn Bhd is one of the Rakaniaga. It means the partnership of Affin Bank SMEColony. Besides that, we have participated in the promotion package too. Don’t miss out! Click here to enjoy your promotion now! https://buy.latitudeinnovation.com.my/promotion/

Click to download your SMEColony app here: https://play.google.com/store/apps/details?id=com.plusnext.smecolonyapp&hl=en